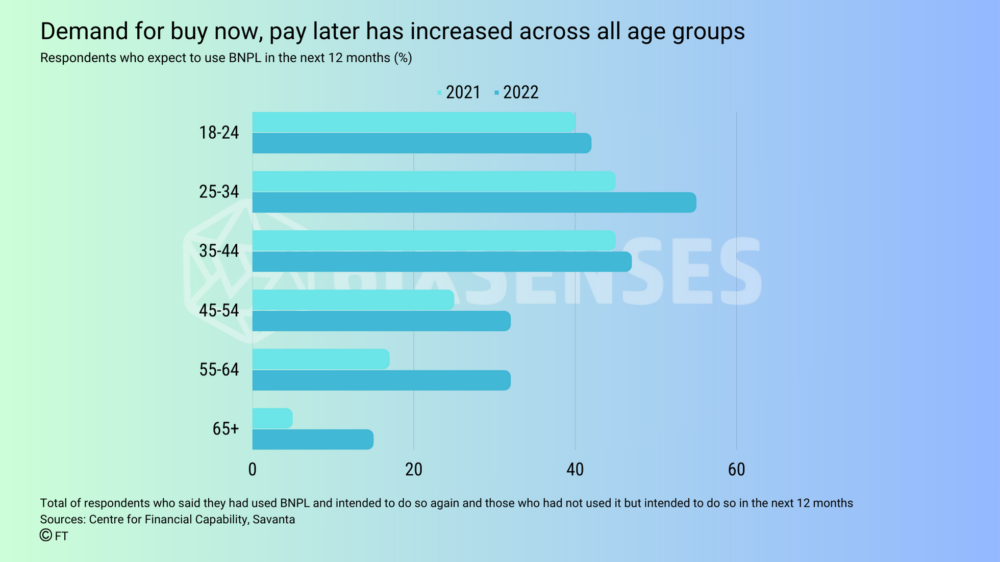

The “buy now, pay later” method (BNPL) has been here for a while. It allows consumers to repay the purchase cost in regular instalments, which are interest-free for so long as consumers pay on time. Some lenders charge late payment fees should a customer fall into arrears, while others solely receive merchant fees for brokering the transaction.

It has been claimed to be a game changer in consumer spending. Several BNPL marketplaces entice you to believe this option provides virtually unrestricted access to BNPL loans. It may make overspending all too simple, so it has become increasingly popular among shoppers. Nonetheless, the appeal of BNPL might lead to impulsive purchases, overspending and other financial insecurity. For that reason, the rapid expansion of the sector, driven by the significant rise in online shopping during the pandemic, has prompted concerns that consumers are taking on unaffordable levels of debt. Indeed, last year, Fitch reported that delinquency rates at some large US BNPL providers had more than doubled, while credit card late payments were relatively flat.

Considering all the above, this article explores the psychological factors to comprehend the reaction of buyers towards BNPL apps which would support individuals to make more informed decisions regarding spending habits.

1. Instant Gratification

If a customer is given the option and simplicity of making payments at no interest over some time, they may engage in impulsive purchasing behaviour. Since there is more wealth, it encourages consumers to spend more on discretionary products. It may feel like a win-win situation. However, the ‘pain of paying’ can only be delayed to a specific date. Therefore, BNPL does not mitigate but defer payments, so mismanaged purchasing can still result in overspending and debt accumulation.

2. Anchoring Bias:

BNPL can be desirable to people by paying in instalments because the monetary loss is perceived as less. This phenomenon’s name is the anchoring bias, where the consumer will decide based on the information available at that time when they are paying only a certain proportion of the total cost of the product. It is perceived that the price is more affordable than it is, but in reality, the looming burden of debt follows.

3. Purchase Dilemma

While this payment method provides more temporary relief for people than traditional payment methods, it has been identified that most people use BNPL for a purchase categorised as a ‘splurge’ or non-essential expense. Instead of utilising the opportunities of BNPL for necessary expenses like rent or groceries, it is spent on commodities that do not optimise the true value of the deferring payments in purchase cost

4. Overconfidence Bias:

This is the tendency of people to overestimate their abilities and knowledge. When it comes to BNPL, this can lead people to believe they will be able to pay back their purchase on time, even if they do not have a solid plan or budget in place. In essence, BNPL provides a powerful medium for people with the discipline to maintain their finances but also a medium for irresponsible spending.